In the whirlwind that is modern life, monetary urgencies can spring up without warning. This unexpected jolt hits particularly hard for those who have ventured into self-employment and are left searching haystacks for exit cues. The painstakingly slow crawl of conventional loans with their red-tape formalities does no good either in these frantic times! Enter quick loans designed specifically to bail out this demographic; an economic safety net swung open at a moment’s notice, offering real rescues from financial peril faster than you could say “self-employed”.

In this write-up, we will delve into the benefits and advantages of the online loan app, shedding light on how they can help self-employed professionals navigate their financial challenges with ease and convenience.

- The Need for Speed

Old-guard banking and finance houses often demand stacks of paperwork, drawn-out sanctioning routines, and guarantees for loans. This lumbering loan dance doesn’t jive with the agile needs of self-employed folks desperate for rapid cash access. Enter expeditious personal loan app options custom-made to be their financial knight in shining armor – quick loans designed specifically for those who work on their terms.

- Speedy Approval Process

There’s a major perk to speedy loans for autonomous individuals, and that is the superfast green lighting it comes with. These nifty advances are tailored specifically toward folks requiring money at short notice without much fuss. The operational mechanism of a cash loan app functions smoothly like oiled gears, often granting clearance within mere moments or an hour—providing timely access to funds precisely when you need them in your arsenal.

- Minimal Documentation

Different from your regular loans demanding heaps of documents, swift credits for self-starters typically require just fundamental documentation. This quick loan paperworks slim-down doesn’t merely save time but streamlines the application procedure, making it much simpler and user-friendly.

- No Collateral Required

A hefty chunk of swift loan schemes tailored to the needs of self-employed folks are unsecured – no collateral required. This is a definite boon for those who might not have an arsenal of high-priced items to promise as surety. Any dread surrounding asset confiscation due to non-payment evaporates, making borrowing feel considerably less demanding and intimidating.

- Flexibility in Loan Amounts

Rapid financing for independent professionals comes in a myriad of magnitudes, giving borrowers the liberty to select an amount that aligns perfectly with their needs. Whether it’s a handful of cash infusion for time-sensitive bills or a larger sum required for scaling up operations – the variability in funding amounts guarantees one can cater precisely towards specific fiscal circumstances.

- Online Accessibility

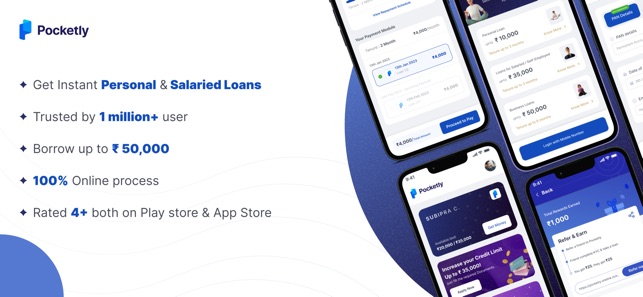

In the thriving era of technology, digital quick loan apps like truebalance has added an extra layer of effortless borrowing. Freelancers now have the ease to apply for necessary financial backing without stepping out from their homes or workspaces, thus bypassing several visits to banking facilities and lenders.

Final Thoughts:

Quick loans are the new superheroes in town, swooping to rescue self-employed folks under both personal and business-sized crises financially. These cash capes provide instant avenues for exploiting opportunities while dodging monetary emergencies on their path towards loftier financial dreams. But don’t forget: with great borrowing comes great responsibility! Steering these rapid rescuers away from transforming into burdens is crucial.

The rise of quick loans tailored for independent workers represents an important evolution in finance – a symbol of adapting gears according to today’s shifting workforce requirements – thus offering accessible, timely solutions for individual fiscal voyages like no other time before.