Does the simple utterance of credit card debts give you goosebumps? Are overdue payments an unwelcome guest in your house? Do concealed costs hide within your bills like economic ghouls and monsters? If you answered a ‘yes’ to these hypotheticals, don’t tremble! A revolt is simmering in the realm of plastic currency – introducing the godsend that is a credit card management application.

Say goodbye to battling multiple apps, hustling against deadlines, and deciphering unclear statements. The next phase for financial organizations has arrived. Envision an environment where your plastic money is at your service rather than you serving it—an environment where handling finances seems as simple as a walk in the park instead of trench warfare. Open arms wide and welcome the intelligent credit card management apps.

These pioneering systems go beyond mere expense-management applications; they’re financial behemoths dressed up as user-friendly dashboards. Picture them as your financial mentor, credit rating advocate, bill payment system (water bill payment, electric bill, monthly expenses etc.) and bonus expert combined into one entity. Let’s explore the enchantment these tools create:

1. Conquer Bill Chaos:

Say farewell to penalty fees and bid goodbye to anxiety-driving paper statement hunts. No more towering stacks of documents ready to avalanche. Intelligent credit card management tools simplify your bill payments (like water bill pay, electric bill) by uniting all account details in one single location. Monitor impending due dates, arrange for automated transactions, and eliminate the stress caused by missed deadlines altogether. It’s like having a virtual assistant whispering “pay this bill now” in your ear, but way less judgmental.

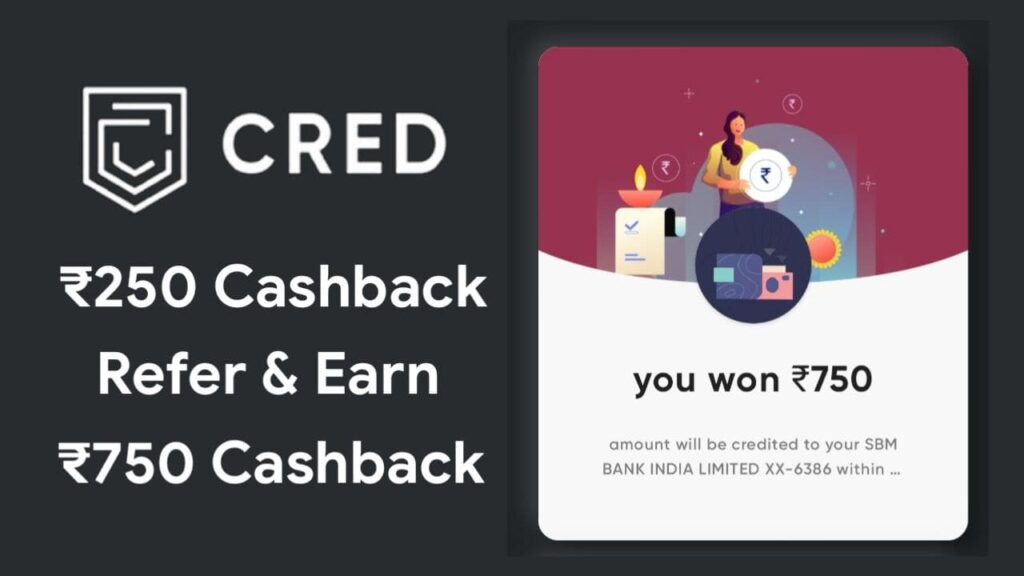

2. Untangle the Rewards Web:

Credit card firm’s reward initiatives present a maze of points, mileage, and cashback benefits. They operate as your private guide through this difficult path to optimize your earnings potential. Monitor point accrual over different cards, weigh up redemption alternatives and discover enormously beneficial deals. Observe how rapidly you accumulate rewards.

3. Track Your Spending Like a Hawk:

Ever wonder where your money goes? These tools offer detailed spending breakdowns across categories, merchants and even send money online transactions. Identify spending patterns, discover hidden subscriptions, and nip unnecessary expenses in the bud. Knowledge is power, and when it comes to your finances, knowing where your money goes is the ultimate superpower.

4. Boost Your Credit Score:

Having a strong credit score equates to economic liberality. These apps offer enlightening perspectives on your financial standing and furnish customized advice for boosting it. Monitor the fluctuations in your rating consistently, stay informed about potential downfalls or setbacks, and rejoice when you reach landmark accomplishments as part of your voyage towards becoming a star with an outstanding credit score.

5. Security You Can Trust:

Worried about data breaches? These platforms prioritize top-notch security with encryption, multi-factor authentication, and fraud protection measures. Rest assured, your financial information is as safe.

It’s time to give up those old-fashioned spreadsheets and quiet, persistent bill chasers and adopt the simplicity of managing credit cards seamlessly. Possessing apt tools can transform your financial disarray into tranquility, debt woes into joyfulness, and potential rewards into tangible benefits. Always remember that you hold the reins over your finances; armed with a little assistance from technology, there will be no need for a panic-stricken bill payment anymore.