The pandemic has shown many families how financially challenging it can be in the case of the main income earner’s demise. It has made more people aware of the importance of having life insurance. Yet, many don’t look beyond the basic factors like premiums and coverage when buying term life insurance. The lack of familiarity with different terminologies often repels individuals from thoroughly researching the options available, resulting in them being ill-equipped with adequate coverage.

Below are some of the common parameters that buyers look for when buying the best term insurance plans.

- The solvency ratio of the insurer – It sheds light on the financial health and ability of the insurer. A good solvency ratio suggests that the insurer is likely not going to default when it’s time to give the payout.

- Commission ratio – This indicates what percentage of the premium amount goes towards agent commissions versus the coverage amount. Lower commissions mean more value.

- Maximum maturity age – Higher maximum ages allow coverage for longer periods.

- Premium mode of payment and frequency – More premium payment and frequency options provide more flexibility.

- Death benefit payout – Lump-sum payouts allow beneficiaries to invest as needed.

- Claim settlement ratio (CSR) – Higher ratios indicate efficient and fair claim settlements.

- Claim complaint frequency – Lower complaint rates suggest smooth claim processing.

How to assess different factors?

Choosing an ideal life insurance policy can be easier if a person knows how to judge the offerings of different insurers quantitatively.

- Individuals should check the different factors against the industry standards. For example, the IRDAI suggests that a solvency ratio above 1.5 indicates a company is financially stable and has sufficient assets to cover policy liabilities.

- View the public disclosures of insurance companies and assess if they adequately perform their duties and answer queries timely.

- Individuals may also view the ratings of different insurers. It’s important to ensure that legitimate agencies do the ratings.

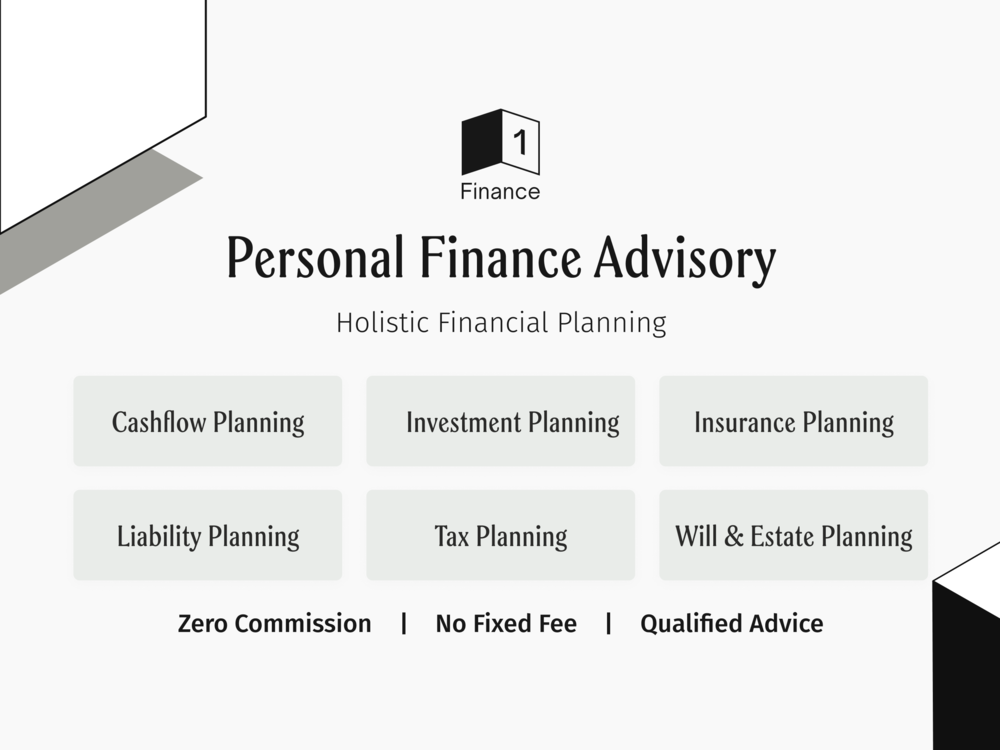

- The term life insurance Scoring and Ranking tool developed by 1 Finance can be a good starting point for those trying to compare term insurance policies and understand the weightage of different factors.

What does the Scoring and Ranking tool do?

The Scoring and Ranking tool uses information like gender, age, and sum assured to present the resourcefulness of different insurer offerings quantitively. Financial ratios, product features, price, and claim’s experience are rated on a scale of 1-100, with a higher number indicating better offerings.

The tool allows term life insurance comparison to be done at a glance, eliminating the need for individuals to spend hours reading the terms and scavenging for the information they’re looking for.

Conclusion:

Term life insurance policies help families regain their financial stability in the case of the demise of the breadwinner. In the present times, people’s increased interest in buying life insurance is often accompanied by anxiety, considering there are multiple factors that an individual might not understand the meaning of. That’s when the Scoring and Ranking tool steps in and eases the decision-making process. By getting all the relevant parameters rated on a quantitive scale, buyers are in a better position to assess if a term life insurance policy is ideal for them.