Personal loans have become an important part of financial planning for many individuals, providing a flexible means to meet various needs. However, to ensure a smooth borrowing experience and safeguard consumers, the Reserve Bank of India (RBI) has set forth guidelines that dictate certain dos and don’ts for both borrowers and lenders. Understanding these guidelines is necessary for a responsible and secure borrowing process.

Do’s:

1. Check the Lender’s Registration with RBI:

Before opting for a personal loan, verify that the lender is registered with the RBI. The central bank regulates and controls financial institutions, ensuring that they comply with necessary guidelines. A registered lender is more likely to adhere to ethical practices and provide a secure borrowing environment.

2. Review Interest Rates:

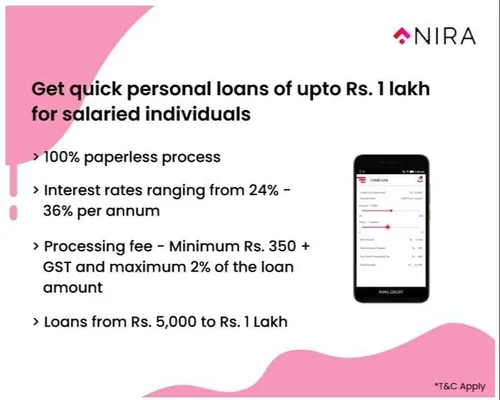

Do compare the interest rates offered by various lenders to secure the best deal. According to RBI guidelines, lenders are required to be transparent about their interest rates and any associated charges. A thorough understanding of the interest structure helps borrowers make informed decisions and prevents financial surprises later.

3. Understand the Terms and Conditions:

Carefully read and comprehend the terms and conditions of the personal loan agreement. RBI mandates lenders to provide clear and concise documentation, including all relevant details such as interest rates, repayment schedules, and penalties for default. Ensure you are comfortable with the terms before committing to the loan. A loan app offers convenient access to these terms and conditions, allowing borrowers to review them easily before accepting the loan.

4. Borrow According to Your Repayment Capacity:

RBI emphasizes responsible lending and borrowing. Borrow an amount that matches your repayment capacity. Assess your monthly income, existing liabilities, and other financial commitments to determine a realistic borrowing amount. This approach minimizes the risk of financial strain and defaults.

Don’ts:

1. Beware of Unregistered Lenders:

Avoid dealing with lenders who are not registered with the RBI. Unregistered lenders may operate illegally and are more likely to engage in unethical practices. Choosing a registered lender ensures a level of credibility and adherence to regulatory standards.

2. Avoid Loan Agreements with Unclear Terms:

Do not sign any loan agreement with unclear or ambiguous terms. The RBI emphasizes transparency in lending practices, and borrowers have the right to a clear understanding of the terms and conditions. If any part of the agreement is unclear, seek clarification from the lender before proceeding.

3. Steer Clear of Unauthorized Deductions:

Personal loan lenders should not make unauthorized deductions from your accounts. If you notice any unauthorized transactions, report them to the lender and the bank immediately. RBI guidelines strictly prohibit unauthorized withdrawals, and lenders are obligated to rectify such issues promptly.

4. Don’t Ignore Credit Score Impact:

Timely repayment of personal loans positively impacts your credit score. On the other hand, defaulting on payments can adversely affect your creditworthiness. Be mindful of your repayment schedule to maintain a healthy credit profile, as this will impact your ability to get credit in the future.

Wrapping Up!

By sticking to these dos and don’ts as per RBI guidelines, borrowers can understand the personal loan landscape with confidence and security. Responsible borrowing practices contribute to a healthy financial ecosystem and promote a positive lending experience for both lenders and borrowers alike. Using a reputable loan app India can simplify the borrowing process and provide access to competitive loan offers.